FAQ: 2022-2025 Proposed CBA Agreement

This agreement includes Low Wage Redress (LWR) in Year 1 – to narrow the gap between our agreement and similar roles in the Facilities Agreement (FBA) in hospitals and care facilities – as well as General Wage Increases (GWI) in each year of the agreement. Years 2 and 3 also include Cost of Living Adjustments (COLA) which are triggered if the rate of inflation exceeds the GWI.

April 1, 2022 (retroactive)

- LWR: Estimated 1.5%

- GWI: 3.24%

April 1, 2023

- GWI: 5.5%

- COLA: Potential for up to 1.25% if inflation exceed 5.5%

April 1, 2024

- GWI: 2.0%

- COLA: Potential for up to 1.0% if inflation exceeds 2.0%

Yes. The pay increases for the first year are retroactive to the first pay period after April 1, 2022.

The pay increases for the first year (an average of 1.5% Low Wage Redress, and a General Wage Increase of $0.25 plus 3.24%) are retroactive to the first pay period after April 1, 2022. All other increases in this tentative agreement would be effective upon date of ratification, unless otherwise specified.

This is entirely under the control of the employer. The union will advocate for retroactive pay to be issued as quickly as possible.

In each of the second and third year of the proposed collective agreement there are General Wage Increases (GWIs) that may potentially be increased through the application of a Cost of Living Adjustment (COLA).

The COLA in the second and third year will be triggered if inflation exceeds the General Wage Increase (GWI) in each of these years.

The COLA cannot result in a reduction of the GWI. For example, if inflation in the second year is below 5.5%, there will not be a reduction in the GWI. The GWI in the second year would still be 5.5%. The three scenarios for the second year are as follows:

- If inflation is not above 5.5% the COLA is not triggered and the GWI will be 5.5%.

- If inflation is above 5.5% but less than 6.75% in the second year, the Adjusted GWI would be equal to the rate of inflation.

- If inflation is at 6.75% or higher in the second year, the adjusted GWI would be 5.5% plus the additional maximum COLA of 1.25% for an Adjusted GWI of 6.75%.

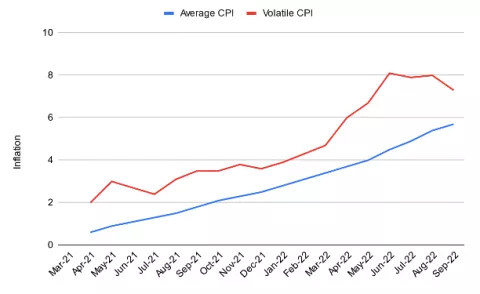

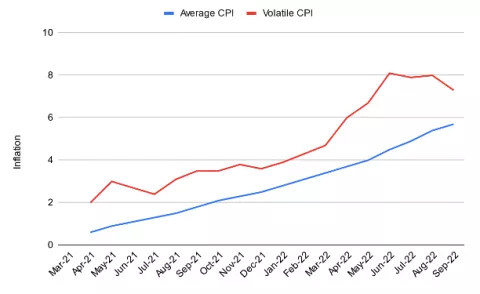

Inflation will be calculated using the annualized average B.C. Consumer Price Index (AABC CPI). The period used to calculate this average is March to February prior to the applicable April general wage increase.

The individual monthly CPI is added together over the 12-month period and then divided by 12 to determine the average. This figure is then compared with the average for the same period for the previous year. The result is the annualized average B.C. Consumer Price Index (AABC CPI).

AABC CPI is a standard measure for calculating inflation-indexed programs, entitlements, and wage triggers. It is used in B.C. for the calculation of allowable rent increases, adjustments to the minimum wage and for MLA salaries.

Using this averaging, the AABC CPI for the period of March 2021 to February 2022 was 3.4%.

If the AABC CPI for the period of March 2022 to February 2023 exceeds 5.5% then the 2023 COLA is triggered.

If the AABC CPI for the period of March 2023 to February 2024 exceeds 2% then the 2024 COLA is triggered.

The agreement’s inflation assumptions are based on the annualized average B.C. Consumer Price Index (AABC CPI). This number differs from some of the higher numbers you might hear about the level of inflation, but this measure provides a more sustainable and predictable foundation for Cost of Living Adjustments over the three years of the agreement — it’s most likely to provide more money for you and other HSPBA members over the duration of the agreement.

You can see that over the past 2 years, both inflation numbers have trended upwards:

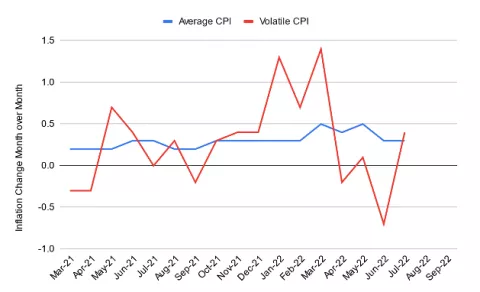

When we look closer at the changes of both numbers from one month to the next, this is what we see:

This is why the average inflation is used to calculate your wage increase: it protects you from sudden drops in volatile inflation so that your wage increase is never at risk.

We have achieved language that permanently ties the Vehicle Allowance rate to the CRA rate for all employees covered by the CBA, including those working for Affiliates.

The CRA has recently announced another increase, and this means that members will receive $0.68 per kilometre for the first 5000 kilometres and $0.62 for each kilometre after that each year.

Are there any improvements to shift premiums?

The Weekend Premium doubles from $0.25 to $0.50 per hour effective (and retroactive to) April 1, 2022.

An Evening Premium will be established for the first time in our agreement effective April 1, 2023. The premium will be $0.25 per hour for shifts where at least half of the hours fall between 4 p.m. and midnight.

The Night Premium remains $2.50 per hour for shifts where at least half of the hours fall between midnight and 8 a.m.

The On Call Rate has been increased from $1.00 per hour to $3.40 per hour effective April 1, 2023.

It’s important that your contact information is up to date so that we can send you the details of the proposed agreement and your link to vote online on the agreement.

Click here to use HSA's online member contact update tool to update your information.

Ask your coworkers if they are receiving HSA emails -- if they are not, encourage them to visit the member contact update tool to update their information and make sure they receive the voting link by email.

All members covered by this tentative agreement will have a chance to vote to accept or reject it.

The voting will be conducted through Simply Voting Inc., an independent, full-service provider of securely hosted online elections. Their voting system was launched in 2003 and currently over 4000 organizations in 67 countries, from municipalities to political parties to unions, rely on Simply Voting to safely execute their elections. Many reputable third parties have audited the company’s product, technical infrastructure, and corporate infrastructure. Customers include the BC General Employees Union, the BC Federation of Labour, the Alberta NDP, and the Mississauga First Nation.

If a majority of voting members reject this agreement, the negotiations team would have to start from scratch. The terms of the proposed agreement would be tossed out, and the process would start again.

This means that while we might be able to achieve a better agreement, we might also be forced to accept a worse one (in which case we would not be able to revisit the previous tentative agreement). The odds of being able to achieve a higher wage increase than that offered by the “Shared Recovery Mandate” are almost zero due to the cost to the government that would impose. (Each public sector agreement ratified in recent weeks has a “me too” clause where they receive the same higher wage increase if it is achieved by another union.)

Your bargaining committee believes the proposed agreement is the best deal possible and is recommending that members vote yest to accept the tentative agreement.